---

tags: web3

---

# 翻譯共筆:DAOs are not corporations: where decentralization in autonomous organizations matters

原文網址:

https://vitalik.eth.limo/general/2022/09/20/daos.html

## 貢獻者

## 翻譯內容

### DAOs are not corporations: where decentralization in autonomous organizations matters

DAO 不是公司:自治組織的權力下放很重要

2022 Sep 20See all posts

2022 年 9 月 20 日查看所有帖子

Special thanks to Karl Floersch and Tina Zhen for feedback and review on earlier versions of this article.

特別感謝 Karl Floersch 和 Tina Zhen 對本文早期版本的反饋和審閱。

Recently, there has been a lot of discourse around the idea that highly decentralized DAOs do not work, and DAO governance should start to more closely resemble that of traditional corporations in order to remain competitive. The argument is always similar: highly decentralized governance is inefficient, and traditional corporate governance structures with boards, CEOs and the like evolved over hundreds of years to optimize for the goal of making good decisions and delivering value to shareholders in a changing world. DAO idealists are naive to assume that egalitarian ideals of decentralization can outperform this, when attempts to do this in the traditional corporate sector have had marginal success at best.

最近,圍繞高度去中心化的 DAO 不起作用的想法有很多討論,為了保持競爭力,DAO 治理應該開始更接近傳統公司的治理。論點總是相似的:高度分散的治理效率低下,由董事會、首席執行官等組成的傳統公司治理結構經過數百年的發展,旨在優化做出正確決策並在不斷變化的世界中為股東創造價值的目標。 DAO 理想主義者天真地認為去中心化的平等主義理想可以勝過這一點,而在傳統企業部門這樣做的嘗試充其量只是取得了微不足道的成功。

This post will argue why this position is often wrong, and offer a different and more detailed perspective about where different kinds of decentralization are important. In particular, I will focus on three types of situations where decentralization is important:

這篇文章將論證為什麼這種立場經常是錯誤的,並提供一個不同的、更詳細的視角來說明不同類型的去中心化在哪些方面很重要。特別是,我將重點關注權力下放很重要的三種情況:

* Decentralization for making better decisions in concave environments, where pluralism and even naive forms of compromise are on average likely to outperform the kinds of coherency and focus that come from centralization.

* 在凹環境中做出更好決策的去中心化,在這種情況下,多元主義甚至天真的妥協形式平均可能優於集中化帶來的一致性和專注。

* Decentralization for censorship resistance: applications that need to continue functioning while resisting attacks from powerful external actors.

* 審查阻力的去中心化:需要在抵禦來自強大的外部參與者的攻擊的同時繼續運行的應用程序。

* Decentralization as credible fairness: applications where DAOs are taking on nation-state-like functions like basic infrastructure provision, and so traits like predictability, robustness and neutrality are valued above efficiency.

* 去中心化作為可信的公平:DAO 承擔類似民族國家功能的應用程序,例如提供基本的基礎設施,因此可預測性、穩健性和中立性等特徵的價值高於效率。

#### Centralization is convex, decentralization is concave

中心化是凸的,去中心化是凹的

See the original post: https://vitalik.ca/general/2020/11/08/concave.html

見原帖:https://vitalik.ca/general/2020/11/08/concave.html

翻譯共筆:https://g0v.hackmd.io/@da0/r1LfQdEds

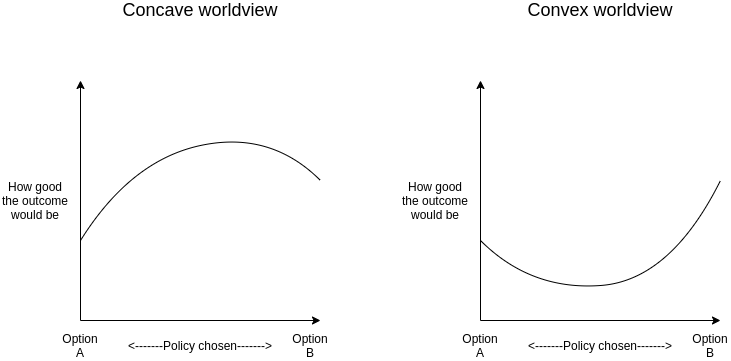

One way to categorize decisions that need to be made is to look at whether they are convex or concave. In a choice between A and B, we would first look not at the question of A vs B itself, but instead at a higher-order question: would you rather take a compromise between A and B or a coin flip? In expected utility terms, we can express this distinction using a graph:

對需要做出的決策進行分類的一種方法是查看它們是凸的還是凹的。在 A 和 B 之間做出選擇時,我們首先看的不是 A vs B 本身的問題,而是一個更高階的問題:你願意在 A 和 B 之間做出妥協還是拋硬幣?在預期效用方面,我們可以使用圖表來表達這種區別:

If a decision is concave, we would prefer a compromise, and if it's convex, we would prefer a coin flip. Often, we can answer the higher-order question of whether a compromise or a coin flip is better much more easily than we can answer the first-order question of A vs B itself.

如果一個決定是凹的,我們更喜歡妥協,如果它是凸的,我們更喜歡拋硬幣。通常,與回答 A 與 B 本身的一階問題相比,我們可以更容易地回答妥協或拋硬幣哪個更好的高階問題。

Examples of convex decisions include:

凸決策的例子包括:

* Pandemic response: a 100% travel ban may work at keeping a virus out, a 0% travel ban won't stop viruses but at least doesn't inconvenience people, but a 50% or 90% travel ban is the worst of both worlds.

* 大流行應對:100% 的旅行禁令可能會阻止病毒進入,0% 的旅行禁令不會阻止病毒,但至少不會給人們帶來不便,但 50% 或 90% 的旅行禁令是兩個世界中最糟糕的.

* Military strategy: attacking on front A may make sense, attacking on front B may make sense, but splitting your army in half and attacking at both just means the enemy can easily deal with the two halves one by one

* 兵法:打A面可能有道理,打B面也有道理,但分兵兩路攻擊,敵方就可以輕鬆對付兩半

* Technology choices in crypto protocols: using technology A may make sense, using technology B may make sense, but some hybrid between the two often just leads to needless complexity and even adds risks of the two interfering with each other.

* 加密協議中的技術選擇:使用技術 A 可能有意義,使用技術 B 可能有意義,但兩者的一些混合往往只會導致不必要的複雜性,甚至增加兩者相互干擾的風險。

Examples of concave decisions include:

凹決策的例子包括:

* Judicial decisions: an average between two independently chosen judgements is probably more likely to be fair, and less likely to be completely ridiculous, than a random choice of one of the two judgements.

* 司法判決:兩個獨立選擇的判決之間的平均可能比隨機選擇兩個判決之一更可能是公平的,並且不太可能是完全荒謬的。

* Public goods funding: usually, giving $X to each of two promising projects is more effective than giving $2X to one and nothing to the other. Having any money at all gives a much bigger boost to a project's ability to achieve its mission than going from $X to $2X does.

* 公共物品資金:通常,為兩個有前途的項目中的每一個提供 X 美元,比向一個項目提供 2X 美元而對另一個項目不提供更有效。與從 $X 到 $2X 相比,擁有任何資金對項目實現其使命的能力的提升要大得多。

* Tax rates: because of quadratic deadweight loss mechanics, a tax rate of X% is often only a quarter as harmful as a tax rate of 2X%, and at the same time more than half as good at raising revenue. Hence, moderate taxes are better than a coin flip between low/no taxes and high taxes.

* 稅率:由於二次無謂損失機制,X% 的稅率通常只有 2X% 的稅率的四分之一有害,同時在增加收入方面有一半以上。因此,適度的稅收比在低稅/無稅和高稅之間擲硬幣要好。

When decisions are convex, decentralizing the process of making that decision can easily lead to confusion and low-quality compromises. When decisions are concave, on the other hand, relying on the wisdom of the crowds can give better answers. In these cases, DAO-like structures with large amounts of diverse input going into decision-making can make a lot of sense. And indeed, people who see the world as a more concave place in general are more likely to see a need for decentralization in a wider variety of contexts.

當決策是凸的時,分散決策過程很容易導致混亂和低質量的妥協。另一方面,當決策是凹的時,依靠人群的智慧可以給出更好的答案。在這些情況下,將大量不同輸入用於決策的類似 DAO 的結構可能很有意義。事實上,那些認為世界總體上更凹的地方的人更有可能在更廣泛的環境中看到權力下放的必要性。

#### Should VitaDAO and Ukraine DAO be DAOs?

VitaDAO 和 Ukraine DAO 應該是 DAO 嗎?

Many of the more recent DAOs differ from earlier DAOs, like MakerDAO, in that whereas the earlier DAOs are organized around providing infrastructure, the newer DAOs are organized around performing various tasks around a particular theme. VitaDAO is a DAO funding early-stage longevity research, and UkraineDAO is a DAO organizing and funding efforts related to helping Ukrainian victims of war and supporting the Ukrainian defense effort. Does it make sense for these to be DAOs?

許多較新的 DAO 與早期的 DAO(如 MakerDAO)不同,因為較早的 DAO 是圍繞提供基礎設施組織的,而較新的 DAO 是圍繞特定主題執行各種任務而組織的。 VitaDAO 是一個資助早期長壽研究的 DAO,而 UkraineDAO 是一個組織和資助與幫助烏克蘭戰爭受害者和支持烏克蘭國防努力相關的工作的 DAO。這些成為 DAO 有意義嗎?

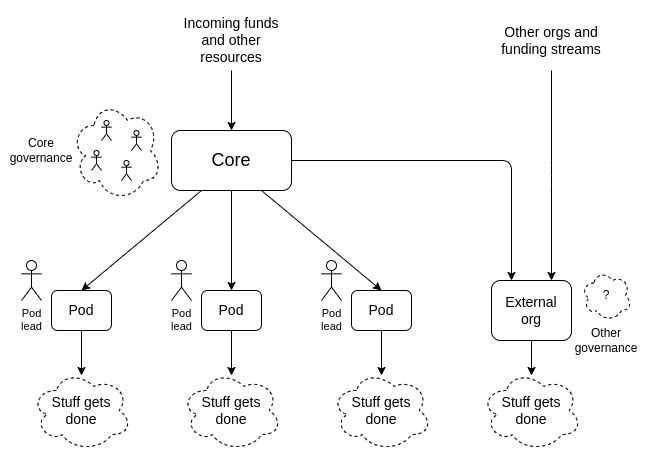

This is a nuanced question, and we can get a view of one possible answer by understanding the internal workings of UkraineDAO itself. Typical DAOs tend to "decentralize" by gathering large amounts of capital into a single pool and using token-holder voting to fund each allocation. UkraineDAO, on the other hand, works by splitting its functions up into many pods, where each pod works as independently as possible. A top layer of governance can create new pods (in principle, governance can also fund pods, though so far funding has only gone to external Ukraine-related organizations), but once a pod is made and endowed with resources, it functions largely on its own. Internally, individual pods do have leaders and function in a more centralized way, though they still try to respect an ethos of personal autonomy.

這是一個微妙的問題,我們可以通過了解 UkraineDAO 本身的內部運作來了解一個可能的答案。典型的 DAO 傾向於通過將大量資金聚集到一個池中並使用代幣持有者投票為每次分配提供資金來「去中心化」。另一方面,UkraineDAO 的工作方式是將其功能拆分到許多 pod 中,每個 pod 盡可能獨立地工作。治理的頂層可以創建新的 pod(原則上,治理也可以為 pod 提供資金,儘管到目前為止資金隻流向了與烏克蘭相關的外部組織),但是一旦創建了 pod 並賦予了資源,它的功能很大程度上取決於它自己的。在內部,各個 pod 確實有領導者並以更集中的方式運作,儘管他們仍然試圖尊重個人自治的精神。

One natural question that one might ask is: isn't this kind of "DAO" just rebranding the traditional concept of multi-layer hierarchy? I would say this depends on the implementation: it's certainly possible to take this template and turn it into something that feels authoritarian in the same way stereotypical large corporations do, but it's also possible to use the template in a very different way.

人們可能會問的一個自然問題是:這種「DAO」不就是在重塑傳統的多層概念嗎?我會說這取決於實施:當然可以採用此模板並將其變成像刻板的大公司所做的那樣感覺專制的東西,但也可以以非常不同的方式使用模板。

Two things that can help ensure that an organization built this way will actually turn out to be meaningfully decentralized include:

有兩件事可以幫助確保以這種方式建立的組織實際上會變得有意義去中心化,包括:

1.A truly high level of autonomy for pods, where the pods accept resources from the core and are occasionally checked for alignment and competence if they want to keep getting those resources, but otherwise act entirely on their own and don't "take orders" from the core.

1.Pod 的真正高度自治,其中 Pod 從核心接受資源,如果他們想繼續獲得這些資源,偶爾會檢查對齊和能力,否則完全獨立行動,不「接受命令」核心。

2.Highly decentralized and diverse core governance. This does not require a "governance token", but it does require broader and more diverse participation in the core. Normally, broad and diverse participation is a large tax on efficiency. But if (1) is satisfied, so pods are highly autonomous and the core needs to make fewer decisions, the effects of top-level governance being less efficient become smaller.

2.高度分散和多樣化的核心治理。這不需要「治理令牌」,但它確實需要更廣泛和更多樣化的核心參與。通常,廣泛而多樣化的參與會大大降低效率。但是如果滿足(1),那麼 Pod 是高度自治的,核心需要做的決策更少,頂層治理效率低下的影響就會變小。

Now, how does this fit into the "convex vs concave" framework? Here, the answer is roughly as follows: the (more decentralized) top level is concave, the (more centralized within each pod) bottom level is convex. Giving a pod $X is generally better than a coin flip between giving it $0 and giving it $2X, and there isn't a large loss from having compromises or "inconsistent" philosophies guiding different decisions. But within each individual pod, having a clear opinionated perspective guiding decisions and being able to insist on many choices that have synergies with each other is much more important.

現在,這如何適應「凸與凹」框架?在這裡,答案大致如下:(更分散的)頂層是凹的,(每個 pod 內更集中的)底層是凸的。給豆莢 X 美元通常比在給它 0 美元和給它 2 美元之間擲硬幣要好,並且妥協或指導不同決策的「不一致」哲學不會造成太大損失。但在每個單獨的群體中,有一個明確的觀點指導決策並能夠堅持許多相互協同的選擇更為重要。

#### Decentralization and censorship resistance

權力下放和審查抵制

The most often publicly cited reason for decentralization in crypto is censorship resistance: a DAO or protocol needs to be able to function and defend itself despite external attack, including from large corporate or even state actors. This has already been publicly talked about at length, and so deserves less elaboration, but there are still some important nuances.

最常被公開引用的加密貨幣去中心化的原因是審查阻力:DAO 或協議需要能夠在外部攻擊(包括來自大型企業甚至國家行為者)的情況下發揮作用並保護自己。這一點已經被公開詳細討論過,因此無需過多闡述,但仍有一些重要的細微差別。

Two of the most successful censorship-resistant services that large numbers of people use today are The Pirate Bay and Sci-Hub. The Pirate Bay is a hybrid system: it's a search engine for BitTorrent, which is a highly decentralized network, but the search engine itself is centralized. It has a small core team that is dedicated to keeping it running, and it defends itself with the mole's strategy in whack-a-mole: when the hammer comes down, move out of the way and re-appear somewhere else. The Pirate Bay and Sci-Hub have both frequently changed domain names, relied on arbitrage between different jurisdictions, and used all kinds of other techniques. This strategy is centralized, but it has allowed them both to be successful both at defense and at product-improvement agility.

當今有大量人使用的兩個最成功的抗審查服務是海盜灣和 Sci-Hub。海盜灣是一個混合系統:它是 BitTorrent 的搜索引擎,這是一個高度分散的網絡,但搜索引擎本身是集中的。它有一個小的核心團隊,致力於保持它的運行,它用打地鼠的地鼠策略來保護自己:當錘子落下時,移開並重新出現在其他地方。海盜灣和 Sci-Hub 都經常更改域名,依賴不同司法管轄區之間的套利,並使用各種其他技術。這種策略是集中的,但它使他們在防禦和產品改進敏捷性方面都取得了成功。

DAOs do not act like The Pirate Bay and Sci-Hub; DAOs act like BitTorrent. And there is a reason why BitTorrent does need to be decentralized: it requires not just censorship resistance, but also long-term investment and reliability. If BitTorrent got shut down once a year and required all its seeders and users to switch to a new provider, the network would quickly degrade in quality. Censorship resistance-demanding DAOs should also be in the same category: they should be providing a service that isn't just evading permanent censorship, but also evading mere instability and disruption. MakerDAO (and the Reflexer DAO which manages RAI) are excellent examples of this. A DAO running a decentralized search engine probably does not: you can just build a regular search engine and use Sci-Hub-style techniques to ensure its survival.

DAO 不像海盜灣和 Sci-Hub; DAO 就像 BitTorrent。 BitTorrent 確實需要去中心化是有原因的:它不僅需要抵制審查,還需要長期投資和可靠性。如果 BitTorrent 每年關閉一次並要求其所有播種者和用戶切換到新的提供商,則網絡質量會迅速下降。要求抵制審查的 DAO 也應該屬於同一類別:它們應該提供的服務不僅要規避永久審查,還要規避單純的不穩定和中斷。 MakerDAO(以及管理 RAI 的 Reflexer DAO)就是很好的例子。一個運行去中心化搜索引擎的 DAO 可能不會:你可以只構建一個常規搜索引擎並使用 Sci-Hub 風格的技術來確保它的生存。

#### Decentralization as credible fairness

權力下放作為可信的公平

Sometimes, DAOs' primary concern is not a need to resist nation states, but rather a need to take on some of the functions of nation states. This often involves tasks that can be described as "maintaining basic infrastructure". Because governments have less ability to oversee DAOs, DAOs need to be structured to take on a greater ability to oversee themselves. And this requires decentralization.

有時,DAO 的主要關注點不是抵制民族國家的需要,而是承擔民族國家的一些職能的需要。這通常涉及可描述為「維護基本基礎設施」的任務。由於政府監督 DAO 的能力較弱,因此需要對 DAO 進行結構化,使其具有更強的自我監督能力。這需要權力下放。

Of course, it's not actually possible to come anywhere close to eliminating hierarchy and inequality of information and decision-making power in its entirety etc etc etc, but what if we can get even 30% of the way there?

當然,實際上不可能完全消除等級制度、信息和決策權的不平等等等,但如果我們能做到 30% 呢?

Consider three motivating examples: algorithmic stablecoins, the Kleros court, and the Optimism retroactive funding mechanism.

考慮三個激勵性的例子:算法穩定幣、Kleros 法院和 Optimism 追溯融資機制。

* An algorithmic stablecoin DAO is a system that uses on-chain financial contracts to create a crypto-asset whose price tracks some stable index, often but not necessarily the US dollar.

* 算法穩定幣 DAO 是一種使用鏈上金融合約創建加密資產的系統,其價格跟踪某個穩定指數,通常但不一定是美元。

* Kleros is a "decentralized court": a DAO whose function is to give rulings on arbitration questions such as "is this Github commit an acceptable submission to this on-chain bounty?"

* Kleros 是一個「去中心化法院」:一個 DAO,其功能是對仲裁問題做出裁決,例如「這個 Github 提交是否可以接受這個鏈上賞金?」

* Optimism's retroactive funding mechanism is a component of the Optimism DAO which retroactively rewards projects that have provided value to the Ethereum and Optimism ecosystems.

* Optimism 的追溯資助機制是 Optimism DAO 的一個組成部分,它追溯獎勵為以太坊和 Optimism 生態系統提供價值的項目。

In all three cases, there is a need to make subjective judgements, which cannot be done automatically through a piece of on-chain code. In the first case, the goal is simply to get reasonably accurate measurements of some price index. If the stablecoin tracks the US dollar, then you just need the ETH/USD price. If hyperinflation or some other reason to abandon the US dollar arises, the stablecoin DAO might need to manage a trustworthy on-chain CPI calculation. Kleros is all about making unavoidably subjective judgements on any arbitrary question that is submitted to it, including whether or not submitted questions should be rejected for being "unethical". Optimism's retroactive funding is tasked with one of the most open-ended subjective questions at all: what projects have done work that is the most useful to the Ethereum and Optimism ecosystems?

在這三種情況下,都需要進行主觀判斷,無法通過一段鏈上代碼自動完成。在第一種情況下,目標只是對某些價格指數進行合理準確的測量。如果穩定幣跟踪美元,那麼你只需要 ETH/USD 價格。如果出現惡性通貨膨脹或其他放棄美元的原因,穩定幣 DAO 可能需要管理一個值得信賴的鏈上 CPI 計算。 Kleros 就是要對提交給它的任何任意問題做出不可避免的主觀判斷,包括提交的問題是否應該因為「不道德」而被拒絕。 Optimism 的追溯資金的任務是解決最開放的主觀問題之一:哪些項目所做的工作對以太坊和 Optimism 生態系統最有用?

All three cases have an unavoidable need for "governance", and pretty robust governance too. In all cases, governance being attackable, from the outside or the inside, can easily lead to very big problems. Finally, the governance doesn't just need to be robust, it needs to credibly convince a large and untrusting public that it is robust.

這三個案例都不可避免地需要「治理」,而且治理也相當穩健。在所有情況下,治理都可能受到攻擊,無論是來自外部還是內部,很容易導致非常大的問題。最後,治理不僅需要穩健,還需要讓大量不信任的公眾相信它是穩健的。

#### The algorithmic stablecoin's Achilles heel: the oracle

算法穩定幣的致命弱點:預言機

Algorithmic stablecoins depend on oracles. In order for an on-chain smart contract to know whether to target the value of DAI to 0.005 ETH or 0.0005 ETH, it needs some mechanism to learn the (external-to-the-chain) piece of information of what the ETH/USD price is. And in fact, this "oracle" is the primary place at which an algorithmic stablecoin can be attacked.

算法穩定幣依賴於預言機。為了讓鏈上智能合約知道是將 DAI 的價值定位為 0.005 ETH 還是 0.0005 ETH,它需要某種機制來了解 ETH/USD 的(鏈外)信息價格是。事實上,這個「預言機」是可以攻擊算法穩定幣的主要場所。

This leads to a security conundrum: an algorithmic stablecoin cannot safely hold more collateral, and therefore cannot issue more units, than the market cap of its speculative token (eg. MKR, FLX...), because if it does, then it becomes profitable to buy up half the speculative token supply, use those tokens to control the oracle, and steal funds from users by feeding bad oracle values and liquidating them.

這導致了一個安全難題:算法穩定幣不能安全地持有比其投機代幣(例如 MKR、FLX……)的市值更多的抵押品,因此不能發行更多的單位,因為如果超過,那麼它就變成了購買一半的投機代幣供應,使用這些代幣控制預言機,並通過提供錯誤的預言機值並清算它們來竊取用戶資金是有利可圖的。

Here is a possible alternative design for a stablecoin oracle: add a layer of indirection. Quoting the ethresear.ch post:

這是穩定幣預言機的一種可能的替代設計:添加一個間接層。引用 ethresear.ch 的帖子:

We set up a contract where there are 13 "providers"; the answer to a query is the median of the answer returned by these providers. Every week, there is a vote, where the oracle token holders can replace one of the providers ...

我們建立了一個合同,其中有 13 個「提供者」;查詢的答案是這些提供者返回的答案的中值。每週都會進行一次投票,預言機代幣持有者可以更換其中一個供應商……

The security model is simple: if you trust the voting mechanism, you can trust the oracle output, unless 7 providers get corrupted at the same time. If you trust the current set of oracle providers, you can trust the output for at least the next six weeks, even if you completely do not trust the voting mechanism. Hence, if the voting mechanism gets corrupted, there will be able time for participants in any applications that depend on the oracle to make an orderly exit.

安全模型很簡單:如果你信任投票機制,你就可以信任 oracle 輸出,除非 7 個提供者同時被破壞。如果您信任當前的一組預言機提供者,那麼您至少可以在接下來的六週內信任輸出,即使您完全不信任投票機制。因此,如果投票機制被破壞,任何依賴預言機的應用程序的參與者將有時間有序退出。

Notice the very un-corporate-like nature of this proposal. It involves taking away the governance's ability to act quickly, and intentionally spreading out oracle responsibility across a large number of participants. This is valuable for two reasons. First, it makes it harder for outsiders to attack the oracle, and for new coin holders to quickly take over control of the oracle. Second, it makes it harder for the oracle participants themselves to collude to attack the system. It also mitigates oracle extractable value, where a single provider might intentionally delay publishing to personally profit from a liquidation (in a multi-provider system, if one provider doesn't immediately publish, others soon will).

請注意該提案的非公司性質。它涉及剝奪治理快速行動的能力,並有意將預言機責任分散給大量參與者。這很有價值,原因有二。首先,它讓外人更難攻擊預言機,也讓新的持幣者更難快速接管預言機。其次,它使預言機參與者本身更難串通攻擊系統。它還降低了預言機可提取的價值,其中單個提供商可能故意延遲發布以從清算中個人獲利(在多提供商系統中,如果一個提供商不立即發布,其他提供商很快就會發布)。

#### Fairness in Kleros

Kleros 的公平性

The "decentralized court" system Kleros is a really valuable and important piece of infrastructure for the Ethereum ecosystem: Proof of Humanity uses it, various "smart contract bug insurance" products use it, and many other projects plug into it as some kind of "adjudication of last resort".

「去中心化法庭」系統 Kleros 是以太坊生態系統的一個非常有價值和重要的基礎設施:Proof of Humanity 使用它,各種「智能合約錯誤保險」產品使用它,還有許多其他項目作為某種「最後裁決」。

Recently, there have been some public concerns about whether or not the platform's decision-making is fair. Some participants have made cases, trying to claim a payout from decentralized smart contract insurance platforms that they argue they deserve. Perhaps the most famous of these cases is Mizu's report on case #1170. The case blew up from being a minor language intepretation dispute into a broader scandal because of the accusation that insiders to Kleros itself were making a coordinated effort to throw a large number of tokens to pushing the decision in the direction they wanted. A participant to the debate writes:

近期,平台的決策是否公正,引發了一些輿論關注。一些參與者提出了案例,試圖從他們認為應得的去中心化智能合約保險平台中獲得賠付。也許這些案例中最著名的是 Mizu 關於案例 #1170 的報告。由於指控 Kleros 內部人士正在協調一致地努力拋出大量令牌,以將決定推向他們想要的方向,該案件從一個小的語言解釋糾紛爆發為一個更廣泛的醜聞。辯論的參與者寫道:

The incentives-based decision-making process of the court ... is by all appearances being corrupted by a single dev with a very large (25%) stake in the courts.

法院基於激勵的決策過程……從各方面來看,都被一個在法院擁有非常大 (25%) 股份的開發者所破壞。

Of course, this is but one side of one issue in a broader debate, and it's up to the Kleros community to figure out who is right or wrong and how to respond. But zooming out from the question of this individual case, what is important here is the the extent to which the entire value proposition of something like Kleros depends on it being able to convince the public that it is strongly protected against this kind of centralized manipulation. For something like Kleros to be trusted, it seems necessary that there should not be a single individual with a 25% stake in a high-level court. Whether through a more widely distributed token supply, or through more use of non-token-driven governance, a more credibly decentralized form of governance could help Kleros avoid such concerns entirely.

當然,這只是更廣泛辯論中的一個問題的一個方面,Kleros 社區將決定誰對誰錯以及如何回應。但是從這個個案的問題來看,這裡重要的是像 Kleros 這樣的東西的整個價值主張在多大程度上取決於它能夠說服公眾它受到強有力的保護,免受這種中心化操縱。對於像 Kleros 這樣的東西要信任,似乎有必要不應該有一個人在高級法院中擁有 25% 的股份。無論是通過更廣泛分佈的代幣供應,還是通過更多地使用非代幣驅動的治理,更可信的去中心化治理形式都可以幫助 Kleros 完全避免此類擔憂。

#### Optimism retro funding

樂觀的複古資金

Optimism's retroactive founding round 1 results were chosen by a quadratic vote among 24 "badge holders". Round 2 will likely use a larger number of badge holders, and the eventual goal is to move to a system where a much larger body of citizens control retro funding allocation, likely through some multilayered mechanism involving sortition, subcommittees and/or delegation.

Optimism 的追溯性創始第一輪結果是由 24 個「徽章持有者」通過二次投票選出的。第 2 輪可能會使用更多的徽章持有者,最終目標是轉向一個由更多公民控制追溯資金分配的系統,可能通過一些涉及抽籤、小組委員會和/或授權的多層機制。

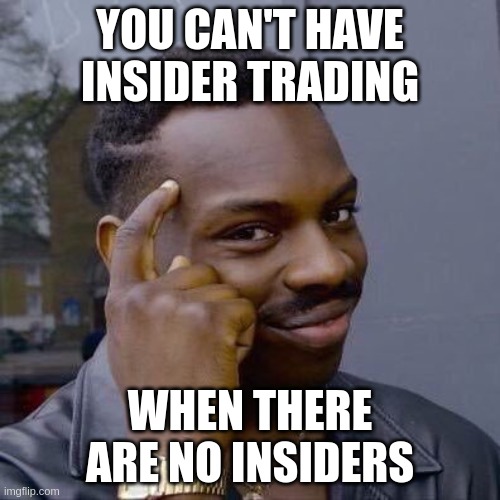

There have been some internal debates about whether to have more vs fewer citizens: should "citizen" really mean something closer to "senator", an expert contributor who deeply understands the Optimism ecosystem, should it be a position given out to just about anyone who has significantly participated in the Optimism ecosystem, or somewhere in between? My personal stance on this issue has always been in the direction of more citizens, solving governance inefficiency issues with second-layer delegation instead of adding enshrined centralization into the governance protocol. One key reason for my position is the potential for insider trading and self-dealing issues.

關於是否擁有更多公民還是更少公民存在一些內部爭論:「公民」是否真的意味著更接近於「參議員」,一個深刻理解 Optimism 生態系統的專家貢獻者,是否應該給予幾乎任何人一個職位顯著參與了 Optimism 生態系統,或介於兩者之間?我個人在這個問題上的立場一直是更多公民的方向,用第二層委託解決治理效率低下的問題,而不是在治理協議中加入神聖的中心化。我持此立場的一個關鍵原因是可能存在內幕交易和自我交易問題。

The Optimism retroactive funding mechanism has always been intended to be coupled with a prospective speculation ecosystem: public-goods projects that need funding now could sell "project tokens", and anyone who buys project tokens becomes eligible for a large retroactively-funded compensation later. But this mechanism working well depends crucially on the retroactive funding part working correctly, and is very vulnerable to the retroactive funding mechanism becoming corrupted. Some example attacks:

Optimism 追溯融資機制一直旨在與前瞻性投機生態系統相結合:現在需要融資的公共產品項目可以出售「項目代幣」,任何購買項目代幣的人都有資格在以後獲得大筆追溯融資補償。但這種機制運作良好,關鍵取決於追溯資助部分是否正常運作,並且很容易受到追溯資助機制腐敗的影響。一些示例攻擊:

* If some group of people has decided how they will vote on some project, they can buy up (or if overpriced, short) its project token ahead of releasing the decision.

* 如果一群人已經決定了他們將如何對某個項目進行投票,他們可以在發布決定之前購買(或者如果定價過高,則做空)其項目代幣。

* If some group of people knows that they will later adjudicate on some specific project, they can buy up the project token early and then intentionally vote in its favor even if the project does not actually deserve funding.

* 如果某些人知道他們稍後將對某個特定項目進行裁決,他們可以提前購買項目代幣,然後故意投票支持它,即使該項目實際上不值得資助。

* Funding deciders can accept bribes from projects.

* 資金決策者可以接受項目的賄賂。

There are typically three ways of dealing with these types of corruption and insider trading issues:

通常有三種方法來處理這些類型的腐敗和內幕交易問題:

* Retroactively punish malicious deciders.

* 追溯懲罰惡意決策者。

* Proactively filter for higher-quality deciders.

* 主動過濾更高質量的決策者。

* Add more deciders.

* 添加更多決策者。

The corporate world typically focuses on the first two, using financial surveillance and judicious penalties for the first and in-person interviews and background checks for the second. The decentralized world has less access to such tools: project tokens are likely to be tradeable anonymously, DAOs have at best limited recourse to external judicial systems, and the remote and online nature of the projects and the desire for global inclusivity makes it harder to do background checks and informal in-person "smell tests" for character. Hence, the decentralized world needs to put more weight on the third technique: distribute decision-making power among more deciders, so that each individual decider has less power, and so collusions are more likely to be whistleblown on and revealed.

企業界通常關注前兩個,對第一個使用財務監控和明智的處罰,對第二個使用面對面訪談和背景調查。去中心化世界對此類工具的訪問較少:項目代幣可能可以匿名交易,DAO 充其量只能有限地求助於外部司法系統,項目的遠程和在線性質以及對全球包容性的渴望使其更難做到背景調查和非正式的面對面的性格「氣味測試」。因此,去中心化的世界需要更多地重視第三種技術:將決策權分配給更多的決策者,這樣每個決策者的權力就會變小,這樣合謀就更有可能被揭發和揭露。

#### Should DAOs learn more from corporate governance or political science?

DAO 應該從公司治理或政治學中學到更多嗎?

Curtis Yarvin, an American philosopher whose primary "big idea" is that corporations are much more effective and optimized than governments and so we should improve governments by making them look more like corporations (eg. by moving away from democracy and closer to monarchy), recently wrote an article expressing his thoughts on how DAO governance should be designed. Not surprisingly, his answer involves borrowing ideas from governance of traditional corporations. From his introduction:

Curtis Yarvin,一位美國哲學家,他的主要「大思想」是公司比政府更有效和優化,因此我們應該通過讓政府看起來更像公司來改善政府(例如,遠離民主,更接近君主制),最近寫了一篇文章,表達了他對DAO治理應該如何設計的看法。毫不奇怪,他的回答涉及借鑒傳統公司治理的理念。從他的介紹:

Instead the basic design of the Anglo-American limited-liability joint-stock company has remained roughly unchanged since the start of the Industrial Revolution—which, a contrarian historian might argue, might actually have been a Corporate Revolution. If the joint-stock design is not perfectly optimal, we can expect it to be nearly optimal.

相反,自工業革命開始以來,英美有限責任股份公司的基本設計基本保持不變——逆勢歷史學家可能會爭辯說,工業革命實際上可能是一場公司革命。如果股份制設計不是完美最優的,我們可以預期它接近最優。

While there is a categorical difference between these two types of organizations—we could call them first-order (sovereign) and second-order (contractual) organizations—it seems that society in the current year has very effective second-order organizations, but not very effective first-order organizations.

雖然這兩種類型的組織之間存在著明顯的區別——我們可以稱它們為一階(主權)組織和二階(契約)組織——但似乎今年的社會有非常有效的二階組織,但不是非常有效的一階組織。

Therefore, we probably know more about second-order organizations. So, when designing a DAO, we should start from corporate governance, not political science.

因此,我們可能對二級組織了解更多。所以,在設計 DAO 時,我們應該從公司治理開始,而不是政治學。

Yarvin's post is very correct in identifying the key difference between "first-order" (sovereign) and "second-order" (contractual) organizations - in fact, that exact distinction is precisely the topic of the section in my own post above on credible fairness. However, Yarvin's post makes a big, and surprising, mistake immediately after, by immediately pivoting to saying that corporate governance is the better starting point for how DAOs should operate. The mistake is surprising because the logic of the situation seems to almost directly imply the exact opposite conclusion. Because DAOs do not have a sovereign above them, and are often explicitly in the business of providing services (like currency and arbitration) that are typically reserved for sovereigns, it is precisely the design of sovereigns (political science), and not the design of corporate governance, that DAOs have more to learn from.

Yarvin 的帖子在識別「一階」(主權)和「二階」(契約)組織之間的關鍵區別時非常正確——事實上,這種確切的區別恰恰是我上面關於可信的帖子部分的主題公平。然而,Yarvin 的帖子緊隨其後犯了一個令人驚訝的大錯誤,他立即轉向說公司治理是 DAO 應該如何運作的更好起點。這個錯誤令人驚訝,因為情況的邏輯似乎幾乎直接暗示了完全相反的結論。因為 DAO 沒有高於它們的主權,並且通常明確地從事提供通常為主權保留的服務(如貨幣和仲裁)的業務,所以這恰恰是主權(政治學)的設計,而不是主權的設計公司治理,DAO 可以從中學到更多。

To Yarvin's credit, the second part of his post does advocate an "hourglass" model that combines a decentralized alignment and accountability layer and a centralized management and execution layer, but this is already an admission that DAO design needs to learn at least as much from first-order orgs as from second-order orgs.

值得讚揚的是,他的帖子的第二部分確實提倡一種「沙漏」模型,該模型結合了去中心化的對齊和問責層以及集中的管理和執行層,但這已經承認 DAO 設計至少需要從中學到同樣多的東西來自二階組織的一階組織。

Sovereigns are inefficient and corporations are efficient for the same reason why number theory can prove very many things but abstract group theory can prove much fewer things: corporations fail less and accomplish more because they can make more assumptions and have more powerful tools to work with. Corporations can count on their local sovereign to stand up to defend them if the need arises, as well as to provide an external legal system they can lean on to stabilize their incentive structure. In a sovereign, on the other hand, the biggest challenge is often what to do when the incentive structure is under attack and/or at risk of collapsing entirely, with no external leviathan standing ready to support it.

主權國家效率低下而公司效率高,原因與數論可以證明很多事情而抽象群論可以證明的事情少得多:公司失敗更少,成就更多,因為他們可以做出更多假設並擁有更強大的工具。公司可以指望當地的主權國家在需要時挺身而出為他們辯護,並提供他們可以依靠的外部法律體係來穩定他們的激勵結構。另一方面,在主權國家中,最大的挑戰往往是當激勵結構受到攻擊和/或面臨完全崩潰的風險時該怎麼辦,而沒有外部利維坦隨時準備支持它。

Perhaps the greatest problem in the design of successful governance systems for sovereigns is what Samo Burja calls "the succession problem": how to ensure continuity as the system transitions from being run by one group of humans to another group as the first group retires. Corporations, Burja writes, often just don't solve the problem at all:

也許在為主權國家設計成功的治理系統時,最大的問題就是 Samo Burja 所說的「繼任問題」:當第一組退休時,如何確保系統從一組人管理過渡到另一組人管理時的連續性。 Burja 寫道,公司通常根本無法解決問題:

Silicon Valley enthuses over "disruption" because we have become so used to the succession problem remaining unsolved within discrete institutions such as companies.

矽谷熱衷於「顛覆」,因為我們已經習慣了公司等獨立機構內部仍未解決的繼任問題。

DAOs will need to solve the succession problem eventually (in fact, given the sheer frequency of the "get rich and retire" pattern among crypto early adopters, some DAOs have to deal with succession issues already). Monarchies and corporate-like forms often have a hard time solving the succession problem, because the institutional structure gets deeply tied up with the habits of one specific person, and it either proves difficult to hand off, or there is a very-high-stakes struggle over whom to hand it off to. More decentralized political forms like democracy have at least a theory of how smooth transitions can happen. Hence, I would argue that for this reason too, DAOs have more to learn from the more liberal and democratic schools of political science than they do from the governance of corporations.

DAO 最終將需要解決繼任問題(事實上,鑑於加密貨幣早期採用者中「致富和退休」模式的絕對頻率,一些 DAO 已經不得不處理繼任問題)。君主制和類似公司的形式通常很難解決繼任問題,因為製度結構與某個特定人的習慣緊密相關,事實證明很難交接,或者風險很高為把它交給誰而鬥爭。民主等更分散的政治形式至少有一個關於如何實現平穩過渡的理論。因此,我也認為,出於這個原因,DAO 可以從更自由和民主的政治學派那裡學到更多,而不是從公司治理中學到。

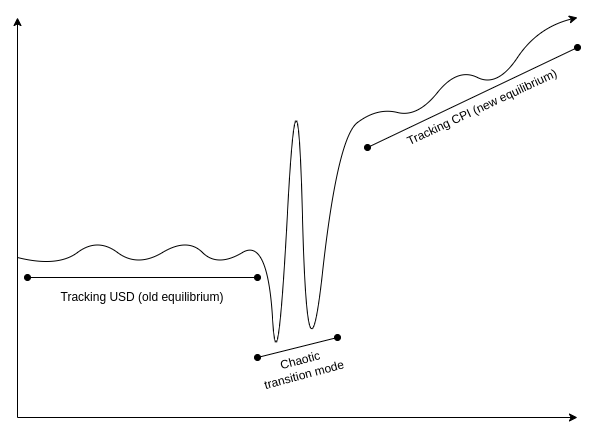

Of course, DAOs will in some cases have to accomplish specific complicated tasks, and some use of corporate-like forms for accomplishing those tasks may well be a good idea. Additionally, DAOs need to handle unexpected uncertainty. A system that was intended to function in a stable and unchanging way around one set of assumptions, when faced with an extreme and unexpected change to those circumstances, does need some kind of brave leader to coordinate a response. A prototypical example of the latter is stablecoins handling a US dollar collapse: what happens when a stablecoin DAO that evolved around the assumption that it's just trying to track the US dollar suddenly faces a world where the US dollar is no longer a viable thing to be tracking, and a rapid switch to some kind of CPI is needed?

當然,DAO 在某些情況下必須完成特定的複雜任務,使用類似公司的形式來完成這些任務可能是個好主意。此外,DAO 需要處理意外的不確定性。一個旨在圍繞一組假設以穩定和不變的方式運行的系統,當面臨這些情況的極端和意外變化時,確實需要某種勇敢的領導者來協調響應。後者的一個典型例子是處理美元崩潰的穩定幣:當一個穩定幣 DAO 圍繞它只是試圖追踪美元的假設而發展時突然面臨一個美元不再可行的世界時會發生什麼跟踪,並且需要快速切換到某種 CPI?

Stylized diagram of the internal experience of the RAI ecosystem going through an unexpected transition to a CPI-based regime if the USD ceases to be a viable reference asset.

如果美元不再是一種可行的參考資產,RAI 生態系統的內部經驗的程式化圖表將經歷意外過渡到基於 CPI 的製度。

Here, corporate governance-inspired approaches may seem better, because they offer a ready-made pattern for responding to such a problem: the founder organizes a pivot. But as it turns out, the history of political systems also offers a pattern well-suited to this situation, and one that covers the question of how to go back to a decentralized mode when the crisis is over: the Roman Republic custom of electing a dictator for a temporary term to respond to a crisis.

在這裡,受公司治理啟發的方法可能看起來更好,因為它們提供了一個現成的模式來應對這樣的問題:創始人組織一個支點。但事實證明,政治制度的歷史也提供了一種非常適合這種情況的模式,並且涵蓋了危機結束後如何回到分權模式的問題:羅馬共和國的習俗是選舉一個獨裁者臨時任期以應對危機。

Realistically, we probably only need a small number of DAOs that look more like constructs from political science than something out of corporate governance. But those are the really important ones. A stablecoin does not need to be efficient; it must first and foremost be stable and decentralized. A decentralized court is similar. A system that directs funding for a particular cause - whether Optimism retroactive funding, VitaDAO, UkraineDAO or something else - is optimizing for a much more complicated purpose than profit maximization, and so an alignment solution other than shareholder profit is needed to make sure it keeps using the funds for the purpose that was intended.

實際上,我們可能只需要少數 DAO,它們看起來更像是政治學的產物,而不是公司治理的產物。但這些才是真正重要的。穩定幣不需要高效;它首先必須是穩定和分散的。去中心化法院與此類似。一個為特定原因引導資金的系統——無論是 Optimism 追溯資金、VitaDAO、UkraineDAO 還是其他——正在優化一個比利潤最大化更複雜的目的,因此需要股東利潤以外的對齊解決方案來確保它保持將資金用於預定目的。

By far the greatest number of organizations, even in a crypto world, are going to be "contractual" second-order organizations that ultimately lean on these first-order giants for support, and for these organizations, much simpler and leader-driven forms of governance emphasizing agility are often going to make sense. But this should not distract from the fact that the ecosystem would not survive without some non-corporate decentralized forms keeping the whole thing stable.

到目前為止,即使在加密世界中,大多數組織也將成為「契約式」二階組織,最終依靠這些一階巨頭的支持,對於這些組織,更簡單和領導者驅動的形式強調敏捷性的治理通常是有意義的。但這不應該忽視這樣一個事實,即如果沒有一些非公司分散的形式來保持整個事物的穩定,生態系統將無法生存。